Annual Anti-Money Laundering and Counter-Terrorist Financing Training for Crypto-Asset Service Providers

Practical, crypto-focused compliance training for your entire team. This course delivers mandatory annual training in Anti-Money Laundering (AML), Counter-Terrorist Financing (CTF), and Sanctions compliance — tailored specifically for crypto exchanges, processors, and other CASPs.

With regulators rolling out MiCA and AMLR, and enforcement actions hitting major players like Binance, Coinbase, and OKX, this training ensures your team is equipped to recognize risks, apply the Travel Rule, identify red flags, and prevent misuse of your platform.

Who this course is for:

- Compliance Officers, MLROs, and Risk Managers at CASPs

- Operations and customer-facing staff handling onboarding and transactions

- Founders and managers seeking regulator-ready governance

- Payment and fintech professionals expanding into crypto

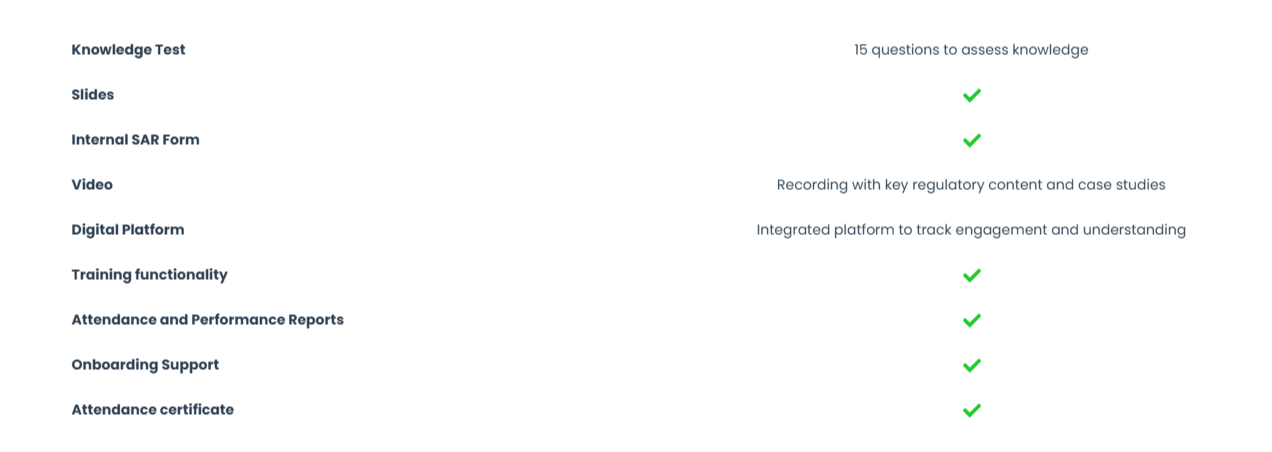

The course comes as a full-service package to suit all your training needs:

Additionally, an internal SAR (Suspicious Activity Report) form is included, which is essential for reporting suspicious activities within your company before submission to the relevant authorities, helping you meet key regulatory requirements. This form is included as a free resource with the course.

Optimize Resources and Maximize Efficiency

We have spent weeks developing this course to provide you with comprehensive, ready-to-use materials. By using this course, you allow your MLRO and Compliance Team to focus on other critical tasks that require their expertise — things we can’t do for you, like building relationships with regulators, or managing complex cases — rather than spending time on routine training creation and compliance testing.

The course includes:

- Video: A recording covering key regulatory requirements and practical case studies, available in English.

- Slides: A full set of training materials designed to cover essential topics in an easy-to-understand format.

- Test: 15 questions to assess understanding and ensure knowledge retention.

- Testing Platform: An integrated platform to test knowledge and track participant engagement, ensuring that employees have fully understood the material.

- Reports: Attendance and performance reports, that can be presented to auditors or regulators.

- Internal SAR Form: A template for reporting suspicious activities internally before formal submission to regulatory bodies.

Package features

Course Benefits

By the end of this course, participants will be able to achieve the following learning outcomes:

- Understand AML and CTF obligations under MiCA and AMLD

- Apply the Travel Rule to crypto transactions

- Recognize red flags of money laundering and terrorist financing

- Identify high-risk typologies (DeFi, NFTs, stablecoins, unhosted wallets)

- Understand sanctions obligations and avoid violations

- File internal and external reports effectively

- Learn from real enforcement cases (Binance, Coinbase, Bitzlato, Tornado Cash, etc.)

Why choose this course?

Unlike generic AML trainings, this program is crypto-specific, regulator-aligned, and based on real case studies. It equips your team not only to comply with laws, but to proactively prevent financial crime risks in crypto operations.

Select an Offer that Suits You